Table of Contents

A solvency certificate serves as proof of financial health when an individual or organisation is unable to satisfy its debts. It is a crucial financial document that certifies the fiscal strength of an individual or entity. Solvency certifications are typically used to demonstrate financial capability and liquidity while attending a visa interview or applying for tenders.

Solvency certifications are provided by banks based on bank account transactions and Chartered Accountant reports. A solvency certificate demonstrates the individual’s or entity’s financial strength. Sometimes government and business offices demand a certificate to verify an individual’s or entity’s financial position. For the following reasons, a certificate is required:

A Solvency Certificate demonstrates an individual’s or an entity’s financial stability and creditworthiness. It attests to the fact that the holder has sufficient assets or financial resources to meet their debt obligations.

A certificate is a crucial requirement in various financial and legal transactions as it assures the parties involved about the other’s financial standing.

The issuance of a Solvency Certificate is typically handled by authorised financial institutions, such as banks. When an individual or entity requires proof of financial stability and creditworthiness, they approach a bank to request a Solvency Certificate. The bank assesses the applicant’s financial standing, considering assets, liabilities, and credit history before issuing the certificate. This document is crucial for various purposes, including visa applications, legal proceedings, and business transactions.

To obtain a solvency certificate a long list of documents is required. However, the documents that need to be kept handy differ from bank to bank and person to person.

However, the following are the basic documents which need to be produced without fail:

All of the above documents must be supplied in their original form for verification. The above-mentioned document requirements may differ from bank to bank. As a result, a candidate should consult with a Vakilsearch expert to determine which document needs to be sent along with the application.

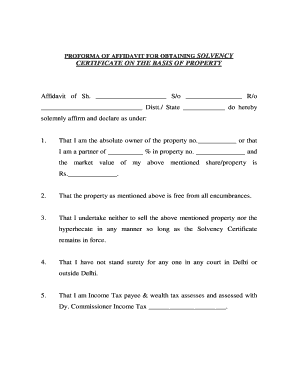

The following is an example of a certificate format issued by an Indian bank. The certificate must be issued on the bank’s letterhead and sealed/signed by the relevant bank officer.

Solvency Certificate Format may vary slightly depending on the specific requirements of the issuing authority, but the following is a basic format that is commonly used:

Date: [Date of issue]

To Whom It May Concern,

This is to certify that [Name of individual or company] has been assessed by [Name of issuing authority] and found to be financially solvent as per the following details:

Based on our assessment of the financial statements provided by the individual/company, we certify that they have the financial capacity to meet their financial obligations, including any outstanding debts or liabilities, as well as any future financial obligations that may arise.

This certificate is being issued at the request of [Name of individual/company] for the purpose of [State the purpose for which the certificate is being issued]. We confirm that the information provided in this certificate is true and accurate to the best of our knowledge.

[Name of issuing authority] [Contact details of the issuing authority]

A Solvency Certificate issued by a bank follows a standard format. It includes essential details such as the applicant’s name, address, the purpose of the certificate, the certified solvency amount and the bank’s stamp and seal.

| The certified solvency amount is the maximum liability that the bank is willing to cover on behalf of the applicant. |

An application for a solvency certificate must be made to the bank where a savings or current account is kept. The banker will issue the certificate after evaluating a variety of different documents and information. As a result, the following information must be included in the application for a solvency certificate:

Send a property valuation report from a Chartered Engineer or Bank Panel Valuer if you want the value of your property considered. While submitting the application, the Banker may request to see the original documentation of the property.

If gold value is to be considered while issuing a solvency certificate, value the gold in your possession using the bank panel valuer. For processing gold loans, banks typically have in-house gold valuers.

If you have money in a savings or current account, you will be required to provide copies of all bank statements under your name.

You will also be required to provide information on any fixed deposit receipts in your name.

Submit a stamped provident fund account statement if money is saved in your provident fund account.

Provide information about any investments you have in mutual funds or stocks. The surrender value of such an investment will be considered when issuing the solvency certificate.

Finally, obtain a net worth certificate with a list of all assets and liabilities from a certified Chartered Accountant. To issue a solvency certificate, most banks mandate the production of a Chartered Accountant-approved Net Worth statement.

You must submit a solvency certificate request form along with a photocopy of each of the records requested by the bank representative when submitting an application for the issuance of the certificate. Remember to carry all original documents as well as the photocopies of all the necessary records with you when submitting the request to the bank.

Tracking the application status of a Solvency Certificate involves direct communication with the issuing bank. After applying, individuals can inquire about the status by contacting the bank’s customer service or visiting the branch in person. This ensures transparency and provides applicants with real-time updates on the progress of their Solvency Certificate request. Effective communication with the bank is key to obtaining timely information and meeting any additional requirements for successful issuance.

Within a week of receiving the solvency certificate request application and all the requisite paperwork, the bank representative who is authorized to issue such a certificate after thorough evaluation will process the application and issue a certificate.

Obtaining a solvency certificate involves certain charges, and these charges can vary from one bank or financial institution to another. The fees associated with obtaining a Certificate typically depend on the amount for which the certificate is requested. Check with your preferred bank or financial institution for their fee structure. In general, most prominent banks operating in India charge a fee of about ₹ 2000 to issue a certificate.

Unlike some documents, Solvency Certificates are not available for download online. To obtain a Solvency Certificate, individuals or entities need to visit the bank or financial institution responsible for issuing it. The application process involves submitting relevant financial documents, completing necessary forms, and paying any applicable fees. Once processed, the bank provides a physical copy of the Solvency Certificate, which serves as official proof of financial stability.

Obtaining a Certificate can sometimes be a complex and time-consuming process. Some of the challenges individuals or businesses may face include

Do note that banks do not take on any liability that may arise in relation to any debt borrowed or liability incurred on the back of such a solvency certificate issued by them.

Need Help! Contact with our Vakilsearch experts by Requesting a callback today!A certificate is a legal document issued by a chartered accountant or a licensed financial institution that certifies that an individual or a company has enough assets and funds to meet their financial obligations. The certificate states that the individual or company has the financial capacity to repay any outstanding debts, including loans, taxes, and other financial liabilities.

A certificate is typically issued by a chartered accountant or a licensed financial institution such as a bank or a credit rating agency. The issuing authority must have the necessary expertise and authority to assess the financial condition of an individual or a company and provide a reliable opinion on their financial solvency.

The validity of a certificate may vary depending on the specific requirements of the organization or agency that is requesting it. Typically, a certificate is valid for a period of six months to one year from the date of issuance. However, some government agencies or financial institutions may require a solvency certificate to be updated every three months or even more frequently, especially in the case of large transactions or loans.

Yes, both individuals and business entities can obtain a Solvency Certificate. The requirements and documentation may vary for each.

Certificates typically have a limited validity period, often six months. The term can be renewed if necessary, by providing updated financial documents and paying the applicable fees.

The solvency amount is determined by the bank based on its assessment of the applicant's financial situation.

Typically, banks require documents such as bank statements, income tax returns, property documents and any other relevant financial records.

Yes, there is a fee associated with obtaining a Certificate, and the processing time can vary depending on the bank.

A Certificate may be required in a variety of circumstances, including visa applications, loan applications, and tender applications for government contracts. It may also be necessary in court proceedings as proof of financial soundness. A solvency certificate serves as an official document attesting to an individual's or entity's financial soundness.

Yes, a Chartered Accountant (CA) can issue a certificate. CAs are authorized financial professionals with the expertise to assess an individual's or entity's financial position and issue a certificate based on their findings.

Solvency documentation refers to the set of financial records and information required to support the issuance of a solvency certificate. This may include bank statements, income tax returns, asset and liability details, and any other relevant financial documents.

The charges for a certificate vary and are typically determined by the issuing authority, which may be a bank or a financial institution. Fees can depend on the amount for which solvency is sought and the policies of the issuing entity.

The declaration of solvency is typically prepared by the individual or entity seeking the solvency certificate. It involves providing accurate and detailed information about financial standing, assets, liabilities, and income. This declaration is then used by the issuing authority, such as a bank or a CA, to assess solvency and issue the certificate.